Step 1: Fill out the form

To open a bank account at Boursorama Banque, you can go Boursorama Banking WebsiteOr download the Boursorama Banque app on your smartphone.

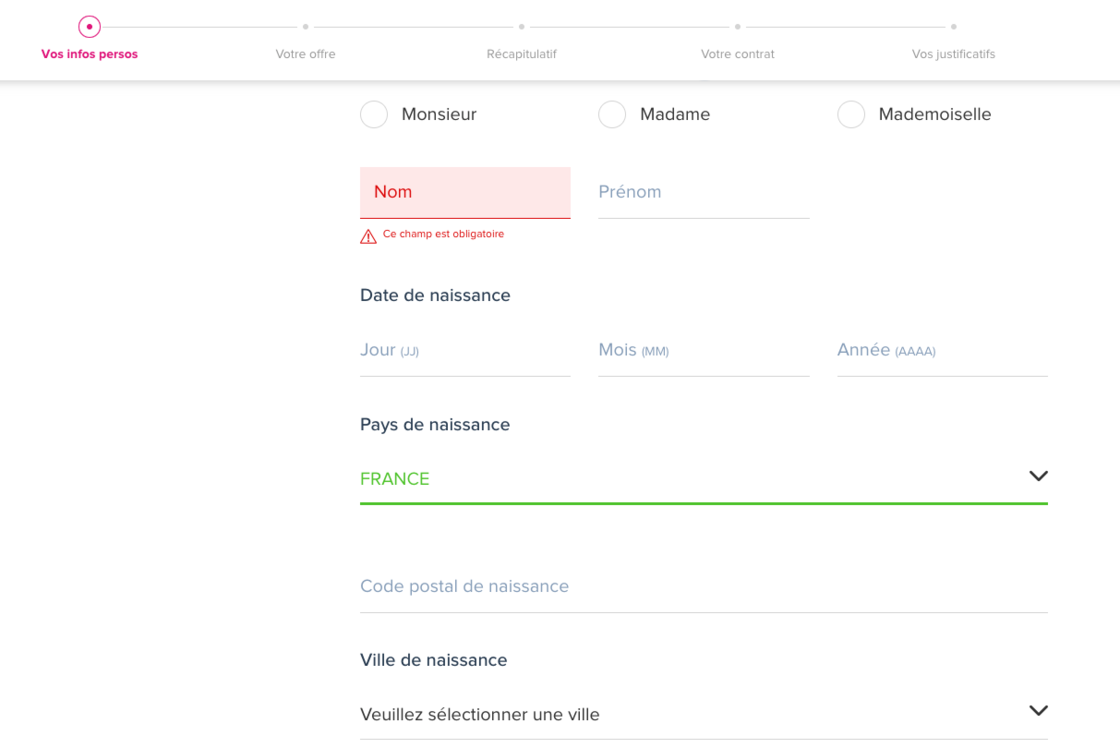

On the website, fill out an online form with your personal information:

- Civilization,

- Last name and first name,

- date of birth,

- Native country,

- Postal birth code,

- City of birth.

On the next page, select:

- Your nationality,

- Your family situation,

- The country where you live.

Attention: You must be a resident of France to open an account at Boursorama Banque.

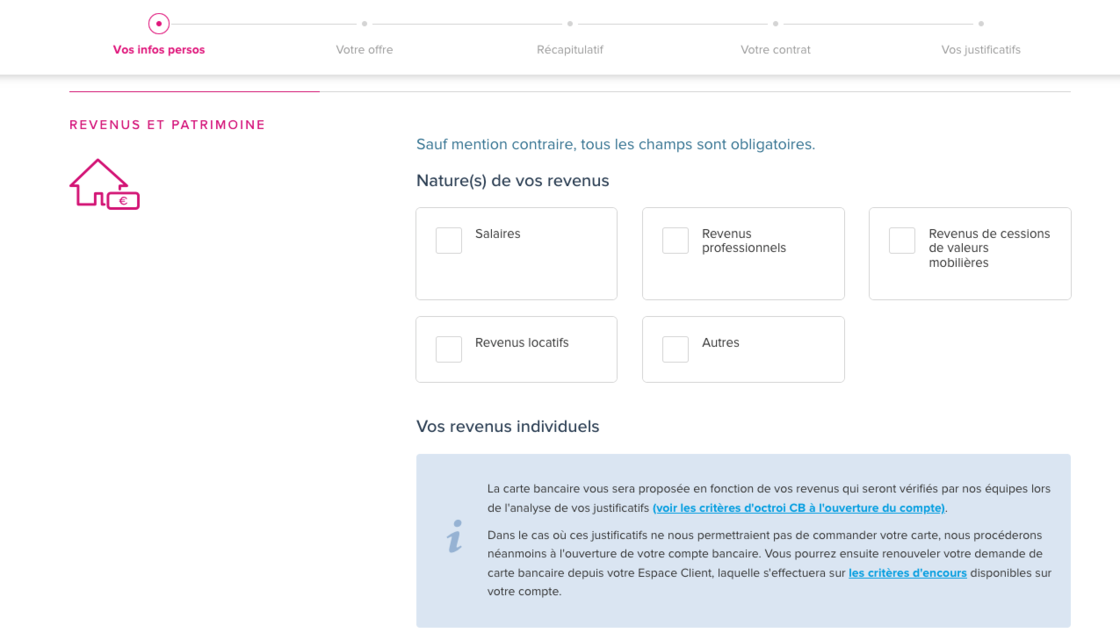

You will be asked about your income:

- Average annual income,

- Socio-professional type,

- Plan whether or not you can use your Boursorama Banque account to receive and save your salary.

In the smartphone application, enter IBAN (International Bank Account Number), Take your first and last name, a photo of your ID, and then take a selfie. Apps ask some questions about your financial status.

In this first stage, it is essential not to make any mistakes. In fact, the information you provide will be used after you create your contract.

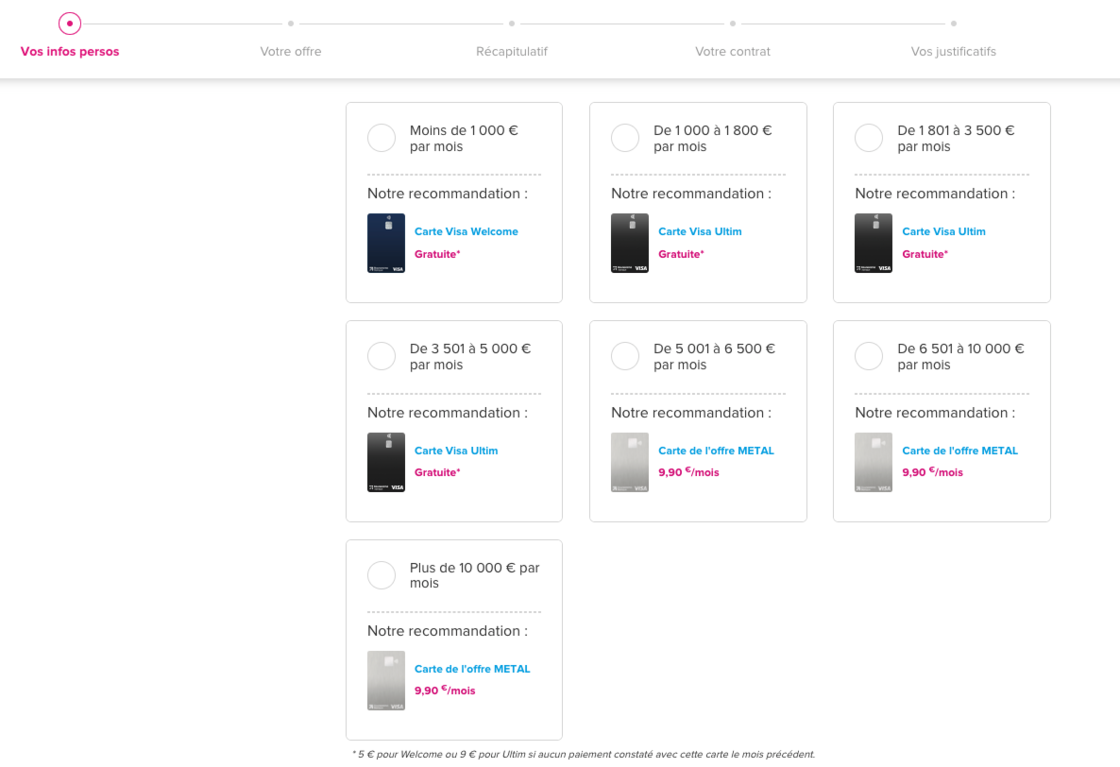

Step 2: Select the bank card

At Boursorama Banque, you have to choose between 3 offers when opening your account:

- Welcome Offer: Bank card with instant debit, without checking. It is free under the terms of use, otherwise 5 euros / month. It allows you to pay 5,000 euros in 30 rolling days and withdraw 400 euros per week.

- Final Offer: The card can be debited immediately (without checking) or deferred (monthly income 1,500 euros). It is free to use, otherwise 9 euros / month. The monthly fee limit is 20,000 euros and the withdrawal limit is 2,000 euros per week.

- Metal offer: card can be debited immediately (without check) or deferred (monthly income 2,500 euros). This is 9.90 euros / month. The monthly fee limit is 50,000 euros and the weekly withdrawal limit is 3,000 euros.

Step 3: Sign the contract

After completing the form, you will receive a summary. Check that the information is correct and click “Verify”. You must sign the contract electronically. Click “Receive my SMS”. You will receive a secret code via SMS to the number specified on the form. A page with your contract will appear and you can download it. If everything is in order, check the boxes, enter the secret code received via SMS and click “I will sign”.

Step 4: Submit supporting documents

To finalize your file, you need to send a limited number of supporting documents to the bank by downloading them from the site:

- Proof may be a color copy of your passport, your identity card or your residence permit. You can scan your document or take a photo on a white background. Accepted files are .png, .jpeg, .bmp, .gif and .pdf. File size must be less than 2 MB.

- Proof of address may be gas, electricity or telephone charges. Just like proof of identity, you can scan it or take a photo.

- The first statement of the bank to which you transfer money to your Boursorama Banque account.

- Handwritten signature: Take a sheet of paper and sign it in the center. Then photograph your signature.

- If you have subscribed to the tested offer, you must send your last two payslips (if you are an employee) or your last tax notice (unless you are an employee).

Then click “Submit My File”. A message will appear stating that your account request is complete. The bank will review your file within 5 business days.

Step 5: Pay the first fee

After accepting your request, Boursorama Banque will email your RIB. To finalize the opening of the account, you will need to transfer 300 euros from the bank details you have already provided to the new Boursorama Banque account. Once the money is received, your new account will be active.

Get our latest news

Every week, important articles with you Personal finance.

Professional bacon fanatic. Explorer. Avid pop culture expert. Introvert. Amateur web evangelist.

More Stories

What Does the Future of Gaming Look Like?

Throne and Liberty – First Impression Overview

Ethereum Use Cases