In the last three months, stocks Thurman Group Holdings (NYSE: THR) 8.00%. Before understanding the importance of debt, let us look at what is the debt of Thurman Group Holdings.

Thurman Group Holdings Credit

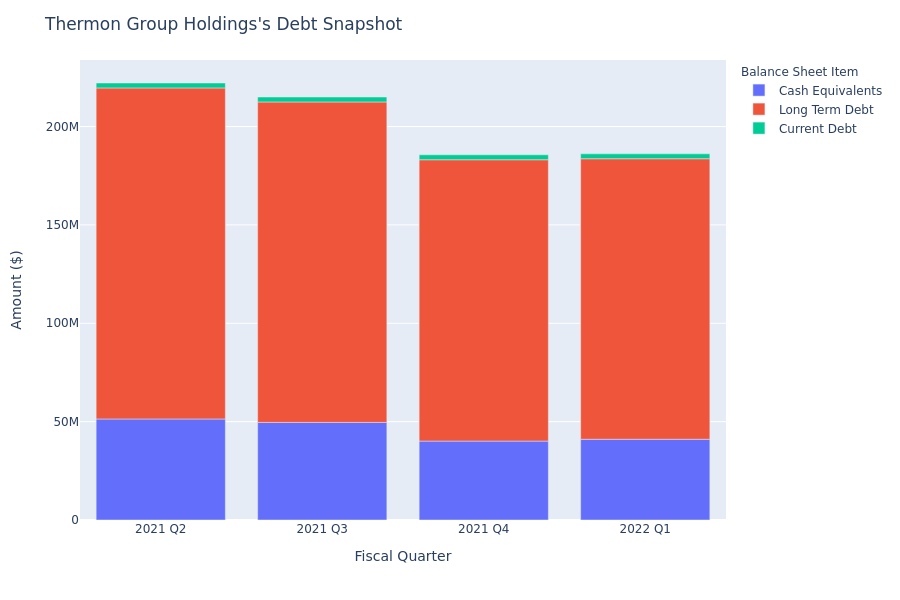

According to Thurman Group Holdings’ annual financial statements dated August 5, 2021, long-term debt is $ 142.60 million and short-term debt is $ 2.50 million, bringing the total debt to $ 145.10 million. $ 41.05 million was converted into cash and cash equivalents, leaving the company with a net debt of $ 104.05 million.

We will define some of the terms used in the paragraph above. A short-term loan is a portion of a company’s debt that must be repaid in one year, while a long-term debt is a portion that must be repaid in more than a year. Cash equivalents include cash and all liquid securities with a maturity of 90 days or less. Total debt is the result of short-term debt and cash equivalent debt after long-term debt.

Should investors sell now? Or is it worth joining Therman?

To understand the size of a company’s financial debt, investors look at the amount of debt. Thurman Group Holdings has a total asset value of $ 624.83 million and a foreign exchange value of 0.23. As a rule of thumb, more than one foreign exchange rate is financed by a significant portion of debt assets. Higher foreign exchange interest rates may indicate that the company may be at default risk. However, leverage rates vary greatly between individual businesses. The debt ratio may be as high as 35% in one business and average in another.

The importance of debt

Debt is a key factor in a company’s capital structure and can help it grow. Borrowing generally has a relatively lower financial cost than equities, making it an attractive option for managers.

However, due to interest paying obligations, a company’s cash flow can be adversely affected. The fund allows forex companies to use the extra capital to run the business so that the shareholders can retain the excess profits generated by the foreign exchange.

Get a free PDF report in Therman: Download it for free here

Looking for stocks with low foreign exchange rate? Go to Bensinga Pro, which offers investors instant access to dozens of stock scales, including leverage. Click here to learn more.

Should Thurman Investors Sell Now? Or is it worth starting with?

Now how does Thurman form? Is your money safe in these stocks? The answers to these questions and why you should act now can be found in a recent analysis of Thermon Stocks.

Thurman: Buy or Sell? Read more here …

Professional bacon fanatic. Explorer. Avid pop culture expert. Introvert. Amateur web evangelist.

More Stories

What Does the Future of Gaming Look Like?

Throne and Liberty – First Impression Overview

Ethereum Use Cases