2021 Advertising Bonus, Application to Start March 1st to 31st: With the start of the booking phase of the tax credit, an updated form and instructions will arrive. The dual discipline of investing in newspapers, including online, and in radio and television, as a result of changes expected by budget law.

2021 Advertising Bonus, Part From March 1st Opportunity to do Question, Inside March 31 is the last day.

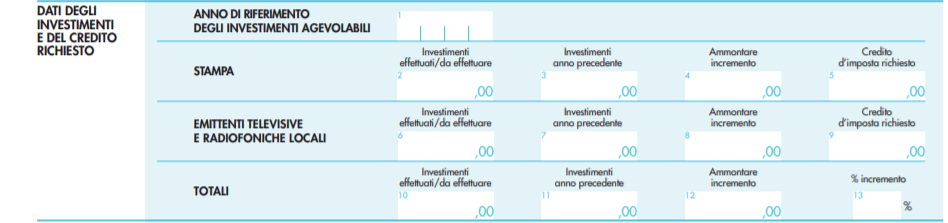

This is the grid Booking of tax credit In advertising investments, a Double discipline for 2021, Due Announcements Introduced Budget Act.

They change Form and instructions You can apply and register for the 2021 Advertising Bonus Investments in printing, Even online, tax credit equals 50 percent, and the need for an increase is no longer valid. Ordinary rules, on the other hand, for investments Advertising on local radio and TV.

2021 Advertising Bonus, March 1 to 31 Application: Updated Form and Instructions

As a result of the changes expected by the 2021 Budget Act, the Information and Publishing Department has been updated Form and instructions On request Advertising bonus.

Begins 1 to March 31, 2021 The first phase of the application process begins, the Advertising investments must be communicated or made In 2021 and access to tax credit is requested.

The list of subjects requesting the advertising bonus will then be published by the Department of Information and Publishing by April 30, 2021, with reference to the theoretical tax credit.

2022 January 1 to 31 We move on to the second phase of application or confirmation of investments through alternative notice.

Sarah Double the discipline provided. As a result of changes introduced by Act No. 170, at 30 December 2020Article 1, paragraph 608, 2021 Advertising Bonus is structured as follows:

- The Tax credit Due is fixed on a single scale 50 percent The value of advertising investments Daily and periodic newspapers, Even online. There is no need for an increase Investment (for 2021 and 2022);

- The Tax credit Approved for investment Television and Radio Stations Fixed instead 75 percent Of increasing value. In this case, normal discipline will return later, which includes requirementsIncrease, at least 1 per cent, In investments made in 2021 compared to 2020.

Double rules about the available ceiling. For investments in newspapers, the 2021 advertising bonus is 50 percent, set aside by the 2021 Budget Act 50 million euros. The available resources should be identified by a specific order of the Chairman of the Committee of Ministers.

- 2021 Advertising Bonus, Investment Contact Module

- Use Tax Credit For Advertising Investments Or Download Updated Communication Form To Be Made In 2021

- Instructions for completing the Advertising Bonus Application 2021

- Download instructions for completing the Advertising Investment Contact Form on Local Newspaper, Radio and TV

2021 Advertising bonus, tax credit for investments in local newspaper and radio and TV

Enters double discipline Contact module For advertising investments, published Department of Information and Publication Updated version February 24, 2021.

Section “Investments and loans required“, To indicate the data of advertising investments made in each media or what needs to be done in 2021.

The following data box should be marked:

- In Column 2, Investments made in the reference year and / or amount to be made in the “print”;

- The Column 3 It should not be finished;

- In Column 6, Investments made during the year referred to in “Local Television and Radio Stations” and / or to be made;

- In Column 7, The amount of investments made in “local television and radio stations” in the previous year.

For investments indicated on the “Local Television and Radio Broadcasters” channel, the web application available on the Revenue Agency website will not allow the compilation of a communication / replacement notice if the percentage of increase shown in column 13 is less than the threshold. 1 percent.

The tax credit requested in relation to the “print” medium shown in column 5 is determined by 50% of the investments and / or measurements to be made in the reference year.

The tax credit requested in respect of the “Local Television and Radio Broadcasters” shown in column 9 is determined at 75 per cent of the increase (column 8).

As stated in Package instructions Of 2021 Advertising Bonus Application, In case of request for access to investment subsidy on newspaper channel and local television and radio stations, Tax credit is calculated by adding two separate credits, Calculated with the different rules above.

Professional bacon fanatic. Explorer. Avid pop culture expert. Introvert. Amateur web evangelist.

More Stories

What Does the Future of Gaming Look Like?

Throne and Liberty – First Impression Overview

Ethereum Use Cases