From May 10 Available on the agency’s website Pre-filled notice 2021, So that citizens can see their own directly 730 already compiled online, Preset based on data for 2020. Therefore, those who wish (and have SPID credentials to do so) can access their own dedicated section of the Inland Revenue Platform and consult their 730 sample or directly. Individuals model.

Each year, Revenue Agency pre-fills out Form 730 based on data sent by third parties to tax authorities for employees and retirees. You can see with your own eyes how much is due to personal income tax credit or how much is due to personal income tax credit.

On the pre-filled 730, there is a lot of information that taxpayers can accept or modify and consolidate, and then Send the notice directly online. This happens when you need to add missing data or make some corrections if necessary.

Taxpayers who accept the pre-filled 730 without making changes will no longer need to show receipts certifying exemption and deduction fees and will not be subject to document checks.

In this guide article we will show users step by step how to do everything for themselves independently:

- Enter the Revenue Agency website,

- Access your personal area,

- See the pre-filled announcement online in 2021

- View the included Irf loan or debit,

- Dates for replacement of 730 or PF model

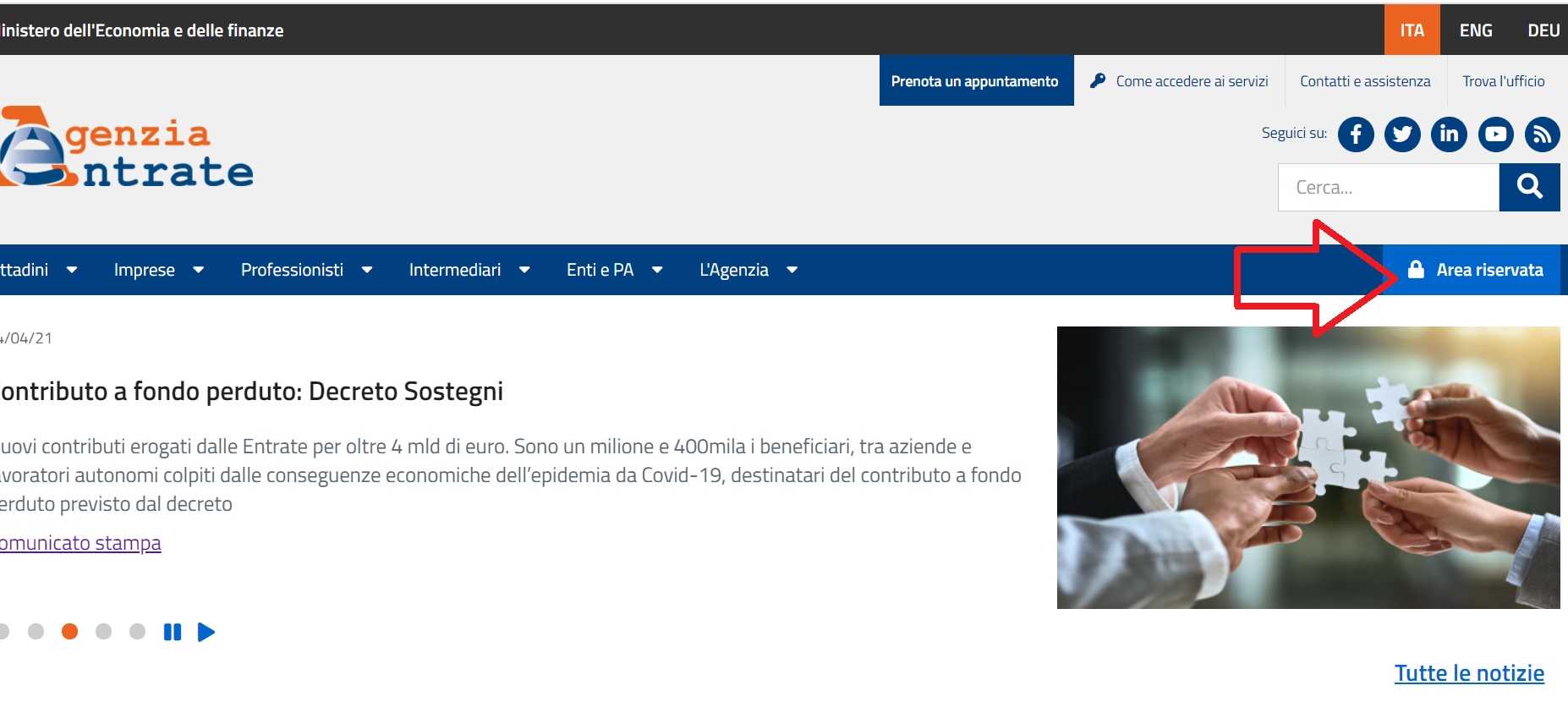

Revenue Company: Access the booked section online

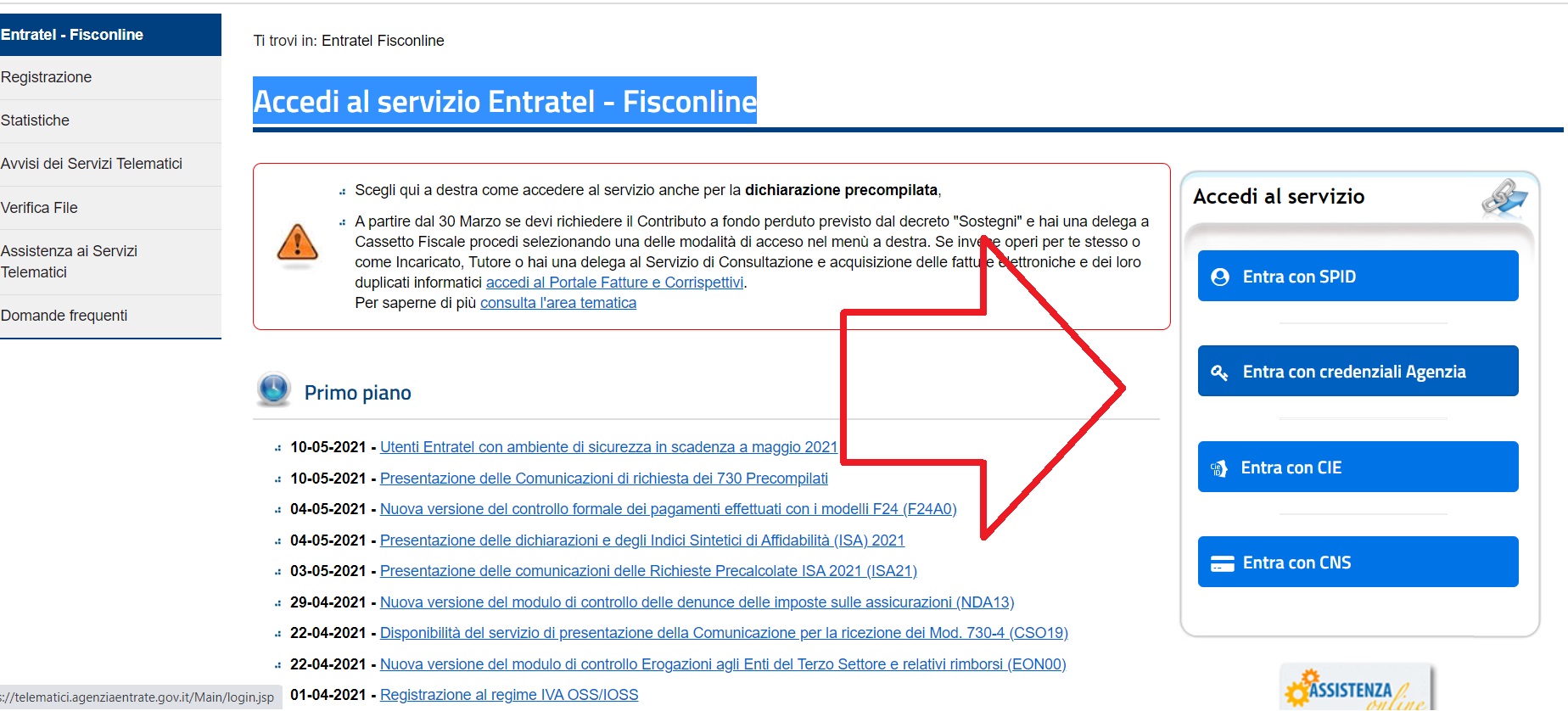

The first step is to log in to the Revenue Agency’s online site and then access your personal area, Certificates Speed, C, CNS or Revenue Company. Follow these steps:

- Access https://www.agenziaentrate.gov.it/portale/

- Click the blue button with the padlock “Allocated area“,

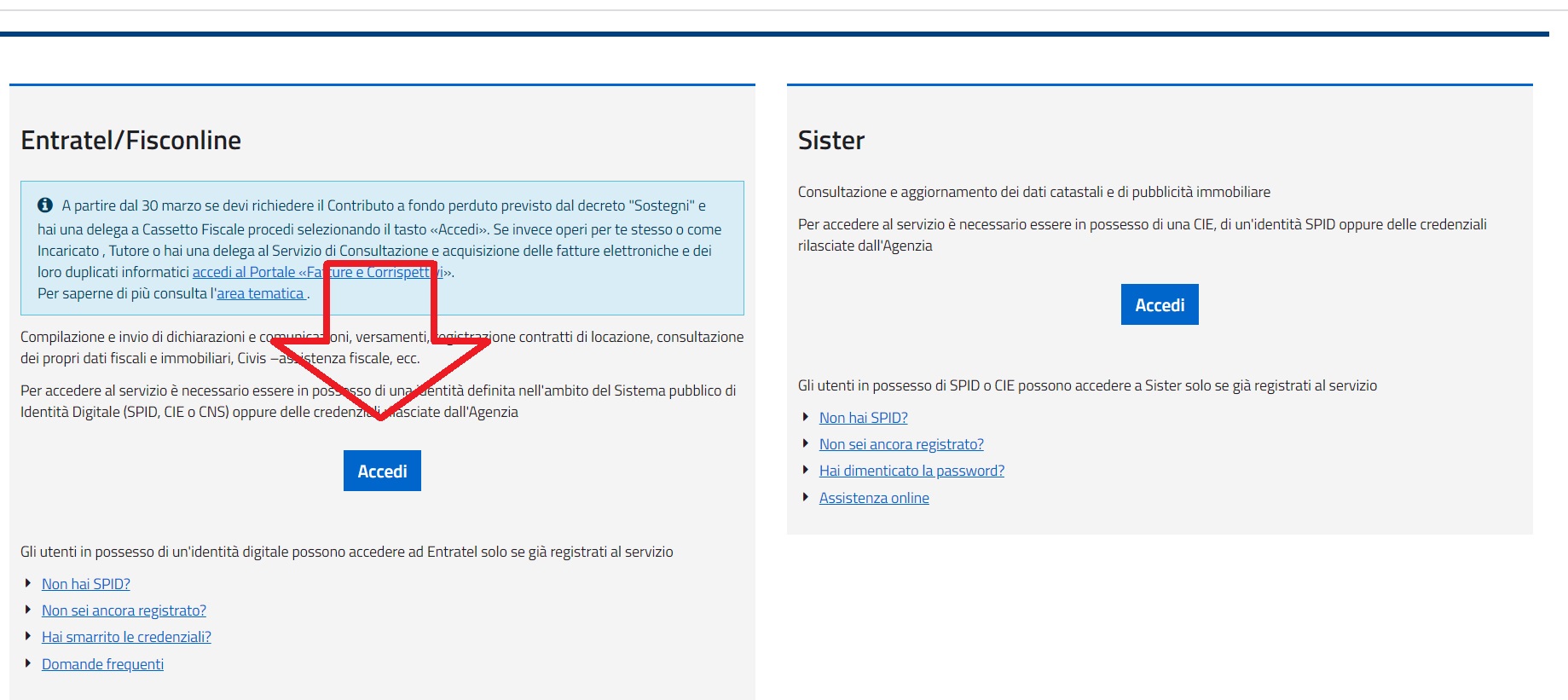

- Entratel / Piscanline window opens, “Sign in “.

> Pre-filled online announcement: How to do it and the 2021 deadlines

If you came here, now follow the next steps:

- “Access Entratal – Bisconeline service opens page, in the column on the right”Sign in to the serviceYou can choose how to access the booked area based on the evidence you have. Click one of these buttons: “Sign in with SPID”, “Sign in with agency credentials”, “Sign in with CIE”, “Sign in with CNS”,

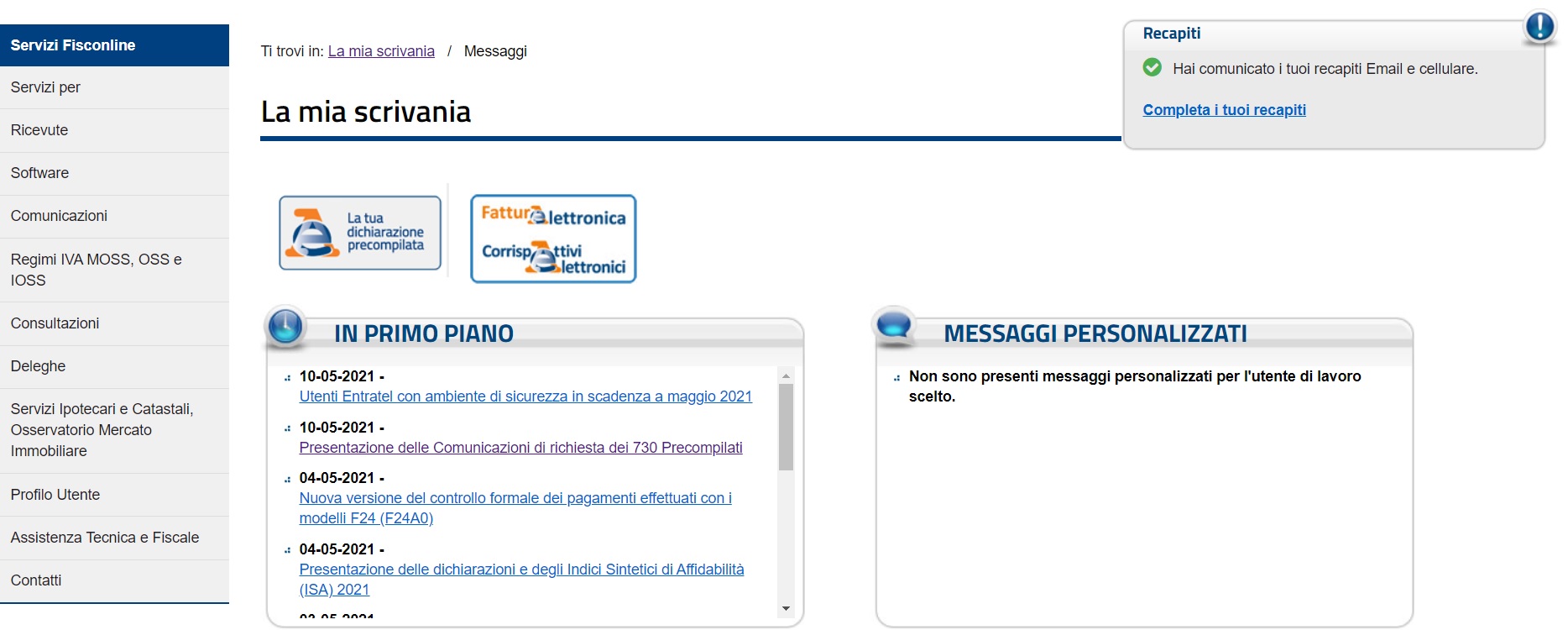

- After logging in, you “My desk“, You will find an overview of your personal area and tax situation.

Pre-filled notice 2021: Deadline

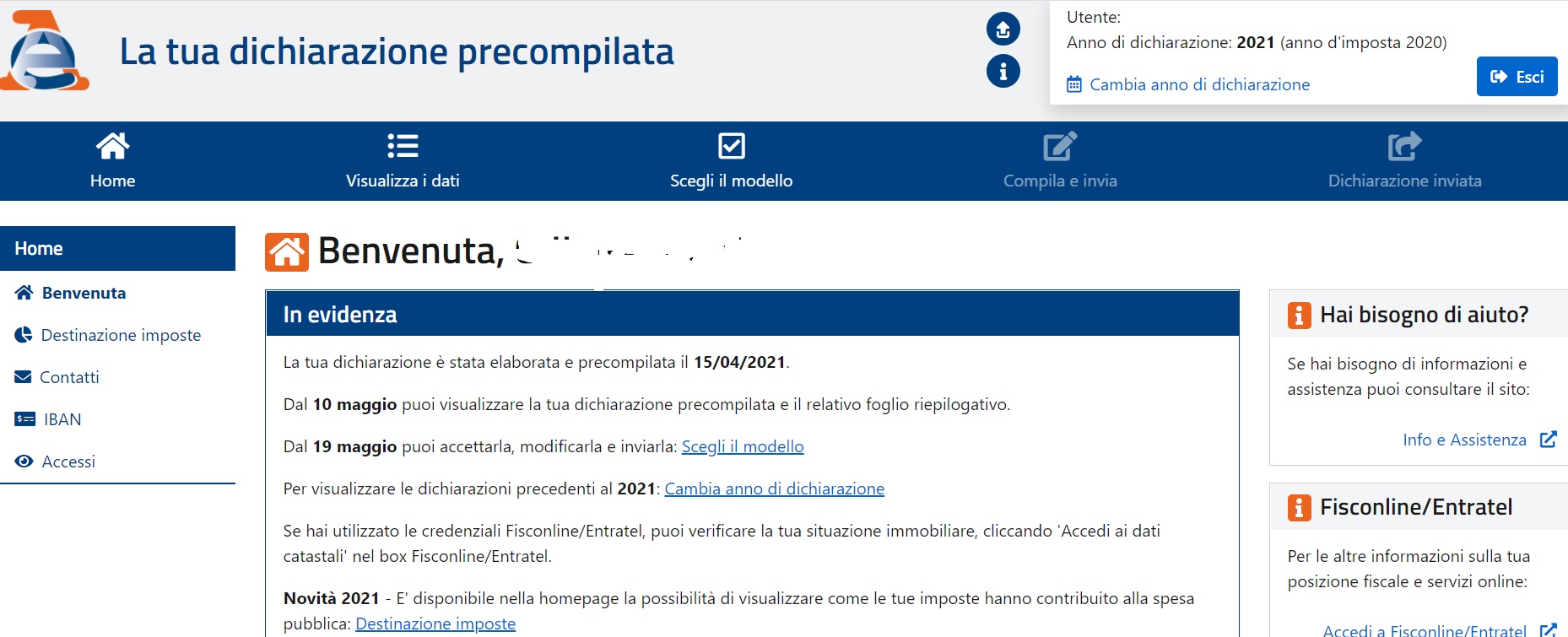

We remind you that from May 10 you will only be able to view your own pre-filled declaration. Nothing else can be done. For the next steps, we must respect this 2021 deadline:

- From May 10, 2021 You can only see the pre-filled online 2021

- From May 19, 2021 In addition to viewing it, you can modify, accept and send your notification.

- On September 30, 2021 Deadline for submitting your tax return

We remind you that you can with the “Edit” option:

- Prepare the joint notice

- Replace pre-filled notification

Special Model 730 <

730 Restoration 2021: How it appears online

Let’s get to the point. All you have to do is enter your virtual line desk:

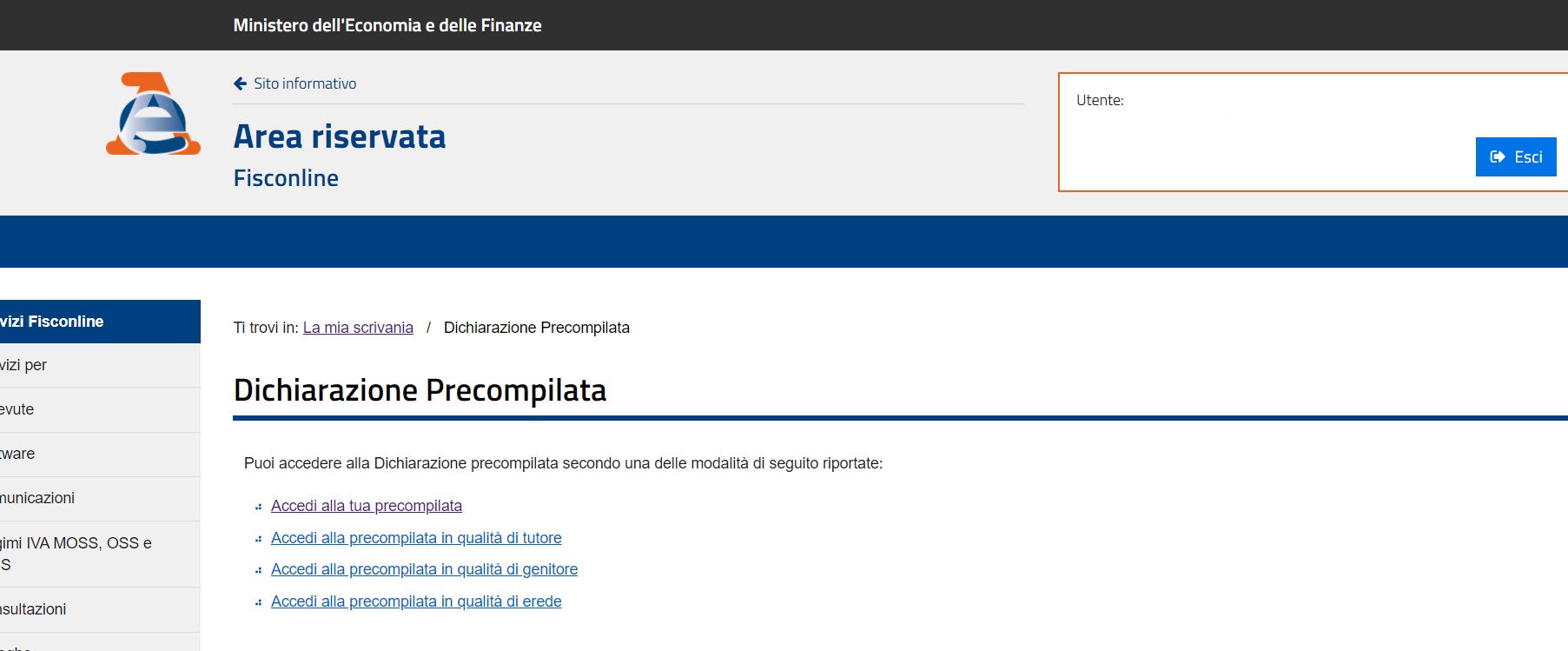

- Click the rectangular banner “Your pre-filled notice“,

- The “Pre-filled Notification” page opens, you need to click here “Access your pre-filled“,

- At this point the next page “Your pre-filled” opens, in which you can find the 730 or pre-filled sample pf, Selecting the model Through agency-led practice,

- Then “Pre-compiled 730 Form“Or”Pre-filled PF Template“, In

- Finally “Confirmation“.

- At this point you can Download the PDF directly Filled in front of you.

Pre-filled in 2021: How to View Personal Income Tax Debt

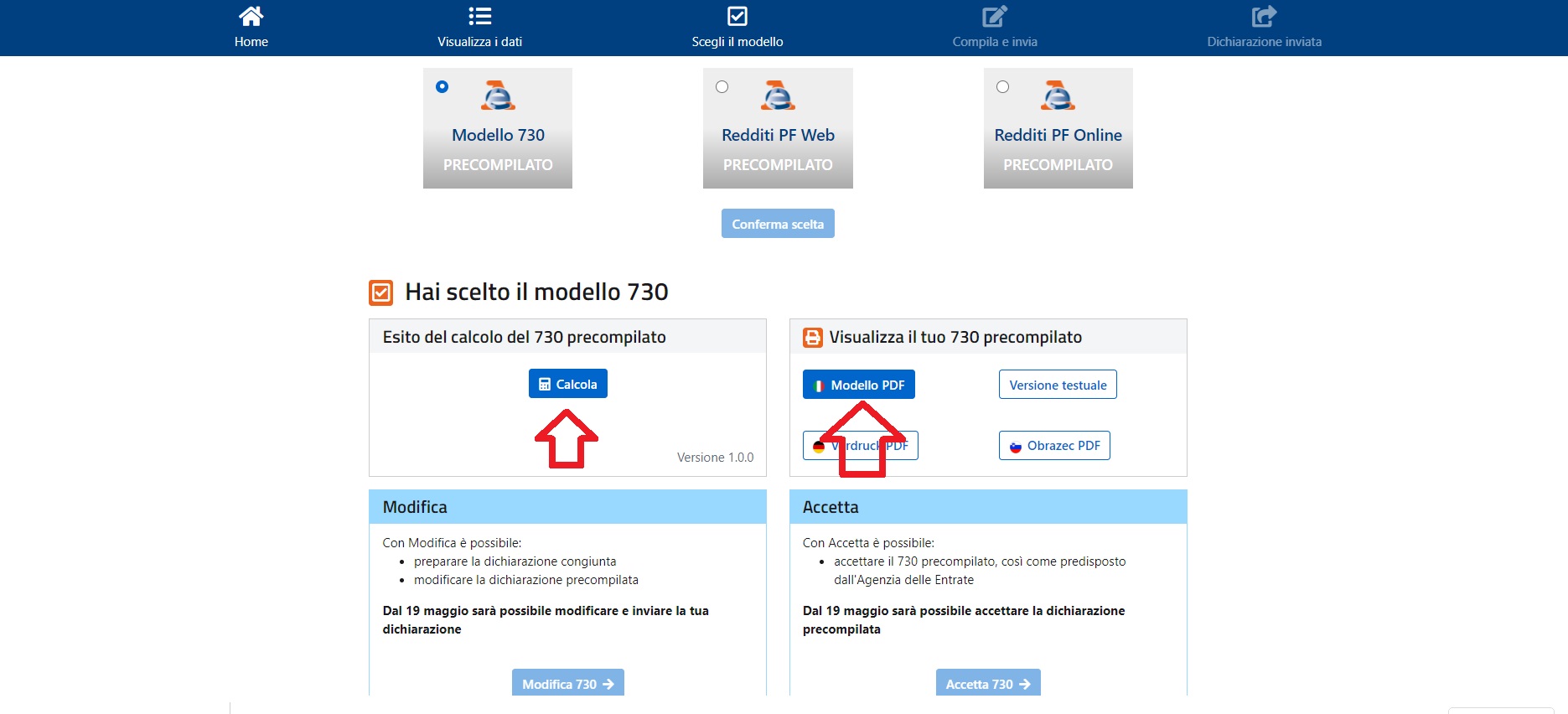

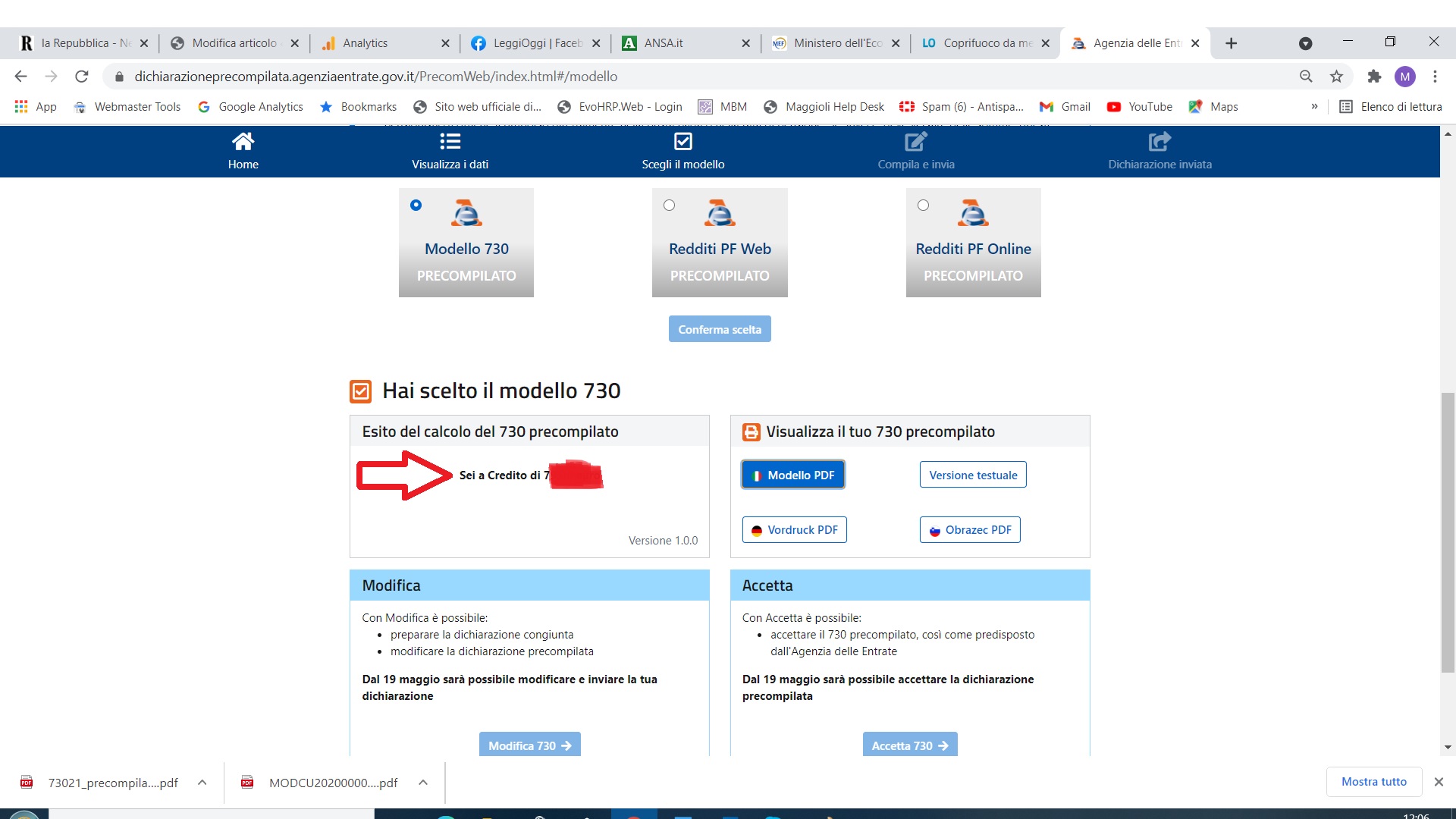

We have reached the basic page, for example, if we have selected the pre-assembled model 730, we can do two important things:

- ClickSee your pre-filled 730PDF of 730 can be downloaded directly to PC from here.

- View Personal Income Tax Credit or Personal Income Tax Credit amount following an online calculation,

- “Click”CalculateThat’s it for the “Pre-compiled 730 results” compiled under the window.

© Reviewed

Professional bacon fanatic. Explorer. Avid pop culture expert. Introvert. Amateur web evangelist.

More Stories

Acrylic Nails for the Modern Professional: Balancing Style and Practicality

The Majestic Journey of the African Spurred Tortoise: A Guide to Care and Habitat

Choosing Between a Russian and a Greek Tortoise: What You Need to Know