Digital Tax 2021, Tax Revenue Form for Digital Services and related instructions come from the Revenue Company. The deadline for submissions is April 30, 2021. Message to be delivered on January 25th.

Digital Line 2021, Everyone is ready to startTax on digital services.

With Organized January 25, 2021, L ‘Revenue Company Provides Notification Template And related Instructions. The Web line Italy is ready to go, as EU regulation on the taxation of web heroes is pending.

The Deadline For telematics transmission related to 2020 data, it has been extended April 30, 2021; When fully operational, it must be exchanged by March 31 of each year.

Day Lessons that are required to send notice, All Instructions For the new exchange DST model, 25 January 2021 We take the news in the arrangement of the revenue system.

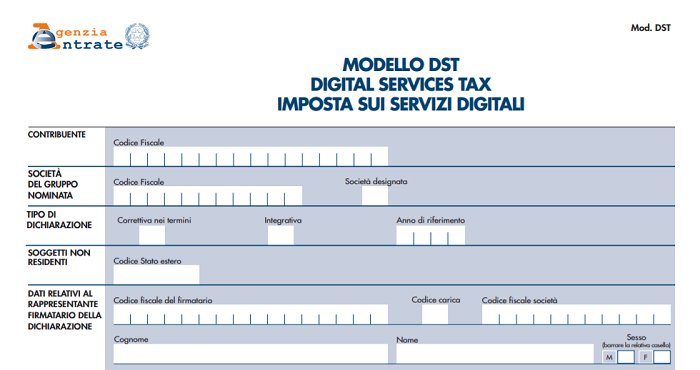

Digital Line 2021, Digital Service Line: DST Notification Template and Instructions

They are obligated to abduct Notification Template RelatedTax on services In the previous tax year, digital subjects doing business activities anywhere in the world, individually or at the group level:

- total amount Revenue not less than 750,000,000 euros;

- A quantity , Revenue from digital services not less than 500 5,500,000 In the territory of the state.

In the corresponding instructions DST Model (Tax on Digital Services) I have also been clarified Non-residents Submit notice in the territory of the state:

- Through a permanent establishment in the territory of the State;

- Directly, if you have a tax code issued by the Italian tax administration;

- Directly, when requesting a tax code, if they do not have one;

- By a specially appointed tax representative.

Passive Lessons of the Digital Line, first identified by the Italian Web Line, 20 January 2021 present, now new Arranged 25 January, Related to the annual notice of tax application.

The Notification Template, With instructions and technical specifications for electronic submission to the Revenue Agency 30 April 2021 deadline.

Order n. Ordered 3/2021 One month extension of transfer period; The normal deadline starting next year is March 31.

- Digital Services Tax Notification Form 2021

- Download the PDF Form for Digital Tax Notice – 25 January 2021 Issue

- Digital Services Tax Notification Form 2021 – Instructions

- Download the instructions attached to the Revenue System Arrangement of 25 January 2021

- Technical Specifications for Digital Services Announcement 2021

- Download Technical Specifications for Electronic Transfers Connected by Revenue Agency 25 January 2021

- Revenue Company – 25 January 2021

- Approval of DST (Digital Service Tax) Form for Notification of Tax for Digital Services, Relevant Procedures for Telecommunication Transfer of Data and Technical Specifications

Digital Tax 2021, who pays for digital services and taxes and deadlines for tax and notification

L ‘Tax on digital services at a rate of 3%, Applies to the provision of the following digital services:

- Disseminating advertising in a digital interface targeting users of the same interface;

- Providing a multifaceted digital interface that allows users to communicate and interact with each other to facilitate the direct delivery of goods or services;

- The data collected from users is exchanged and generated through the use of a digital interface.

There are two Deadline Remember, both are order numbers. 3/2021:

- The Deadline for payment of tax It is set for March 16, 2021, instead of the normal deadline of February 16;

- The Deadline for submission of DST Notification Form It is set for March 31, 20 April 2021, instead of the normal deadline of March 31.

| Digital line | Deadline 2021 | Deadline when fully operational |

|---|---|---|

| Digital service tax payment | March 16, 2021 | February 16 |

| Sends notification of digital services | April 30, 2021 | March 31 |

The last missing piece is now relevant Tax code For payment using Form F24, a separate resolution must be established.

On the other hand, citizens who do not have a current account at a bank or post office branch located in Italy and are unable to make payments with Form F24 should pay by bank transfer.

- Chapter 8 – In support of the State Budget in Chapter 1006 (IPAN Code IT43W0100003245348008100600),

- The tax code, tax code and reference year indicate the reason for the transaction.

Professional bacon fanatic. Explorer. Avid pop culture expert. Introvert. Amateur web evangelist.

More Stories

Acrylic Nails for the Modern Professional: Balancing Style and Practicality

The Majestic Journey of the African Spurred Tortoise: A Guide to Care and Habitat

Choosing Between a Russian and a Greek Tortoise: What You Need to Know