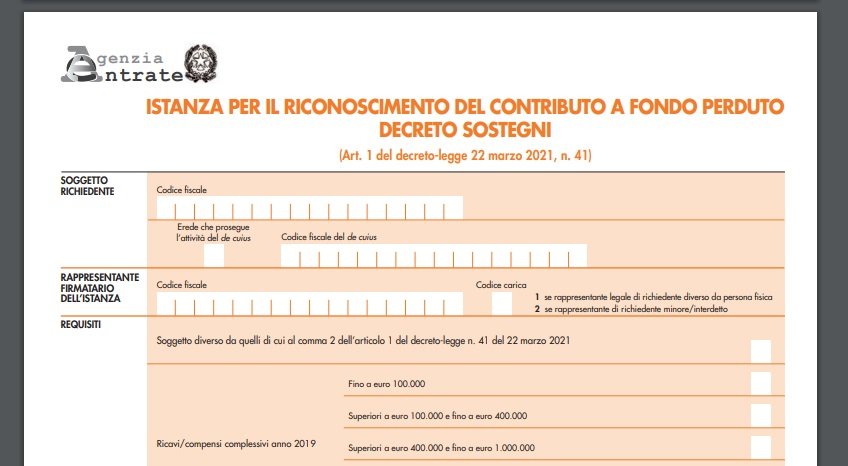

The government has paid $ 11 billion for VAT, which is said to have been damaged by the closures of the temple. There are two requirements for obtaining the contribution predicted by DL Sostechni. First, 2019 revenue or wages not exceeding 10 million euros. The second requirement to be met is that the average monthly income and fees for 2020 are at least 30% lower than the average monthly sales and fees for 2019. Contribution also occurs in the absence of a reduction in income / fees for subjects who have implemented the VAT number from 1 January 2019, subject to the condition of an income of 10 million euros or a salary cap.

How is the contribution of DL Sostechni calculated?

According to this summary plan, the size of the contribution is determined by using one percent of the difference between the average monthly turnover and the fee for 2020 and the average monthly sales and fees for 2019:

- 60% if income and wages for 2019 do not exceed the limit of 100 thousand euros;

- 50% if income and wages for 2019 exceed 100 thousand euros up to 400 thousand;

- 40% if the revenue and salary for 2019 exceeds 400 thousand euros to 1 million;

- 30% if revenue and wages for 2019 exceed 1 million euros up to 5 million;

- 20% if the revenue and salary for 2019 exceeds 5 million euros to 10 million.

However, the minimum contribution is guaranteed not less than 1,000 euros for individuals and 2,000 2,000 for individuals other than individuals. The amount of the authorized contribution should not exceed 150,000 in any case.

Also read: Refreshing Order 5, VAT numbers and new help for shoppers here

For each application, the agency system will carry out checks and issue receipts to the person who submitted the application. In particular, in the event of a positive outcome, the payment order for the GDP contribution (or recognition as a tax credit during this examination) will be contacted in the designated area of the portal. “Invoice and fee”-“ Non-Refundable Grant – Outcome Advice ”section is accessible to the applicant or his or her representative broker.

Also read: VAT Numbers and Dismissal Fund for Specialists What is ISCRO?

Who is entitled to the contribution of DL Sostechni?

D.L. For the implementation of the order (for most subjects it is 2019) the revenue or salary has not exceeded 10 million euros. Furthermore, in connection with the conduct of business activities, this contribution is also made by non-commercial organizations, including third party companies and civil recognized religious institutions. On the other hand, those who implemented the order (March 23, 2021) or VAT number (from March 24, 2021), public organizations (Art.), Financial intermediaries and holding companies (Section 162-BIS of TUIR).

Professional bacon fanatic. Explorer. Avid pop culture expert. Introvert. Amateur web evangelist.

More Stories

Acrylic Nails for the Modern Professional: Balancing Style and Practicality

The Majestic Journey of the African Spurred Tortoise: A Guide to Care and Habitat

Choosing Between a Russian and a Greek Tortoise: What You Need to Know