Written by Oliver Brunett

SEO & Transport Strategist: Kamil Radicchi

Astir, or Income Tax Notice Status Notice, is an online document that serves as evidence of doing certain procedures without waiting to receive a tax declaration. Terms, Receipts, Application … All about Astir 2021.

What is Astir? Definition

Astir = Notice of income tax return status

Astir means notice of income tax return status. This is an official document issued by the tax administration that makes it immediately available to taxpayers who file an online tax return on Impots.gouv.fr.

Since 2016, Astir has changed the non-taxable notice for those subject to income tax. (Be brave)

This year, the 2021 Income Tax Notice Status Notification 2020 is newly available online.

The title of the document is as follows:

Income tax for 2020

Announcement status announcement drawn up in 2021

Justify your income and expenses to third parties

Aster is a two or three page document that you can view:

- Taxpayer Tax Notes: Announcers Tax Nos. 1 and 2, FIP Number, Tax Address on January 1, 2021, Date of Establishment (Related to Online Notification Date)

- Tax Administration Contacts: Messaging, Telephone Number, Link Public Finance Center

- Amount to be paid or refunded by the tax authorities in the summer

- Tax Information: Major tax income and number of tax shares

- Details of income, fees, tax deduction and debt, pension savings ceiling

Aster is especially used:

- Evidence for doing multiple administrative or day-to-day operations, especially when you do not yet have a tax return

- Evidence to request or verify eligibility for certain social assistance

- Find out your reference tax returns

- Find out the number of shares of his tax family

Astir and tax declaration, what are the differences?

Aster is a document that is automatically and instantly generated when you complete an online declaration of current income and fees (salaries and wages, pensions, property income), i.e. 80% of taxable households. In a limited number of specific cases, Aster will not be available once the online notification has been verified.

Atheer provides information on the status of the tax house after the completion of the online income declaration, as well as the amount of tax payable or the amount to be repaid, but did not give any indication of payment dates.

The tax declaration, as its name implies, is a document in which the taxpayer has to pay his tax arrears and social contributions. Every taxpayer will receive a tax notice in the summer without exception. It becomes available to tax authorities four or five months later than an Austrian. Astir does not change the tax return for taxable persons, but this document may be useful in an interim way to make certain procedures.

How to get Astir 2021 without applying

Where to find the 2021 announcement status announcement online

Astir 2021 is obtained without making any request to the tax administration. This announcement is automatically available at the end of 2020 online tax returns.

How do I get it? All you have to do is download Austria in PDF format:

- As soon as the online income declaration is verified

- in your personal space at impots.gouv.fr

Where can I find the 2021 announcement status announcement? The procedure to download Astir 2021 several days or several weeks after the online announcement is as follows:

- Go to www.impots.gouv.fr

- Click the blue button “Your Personal Location” (top right)

- Enter identifiers (line number and password) or connect to a private area using the France Connect button

- Click the “Documents” tab

- In the line “2021 Income Tax Statement 2020 Notification”, click the “View PDF” button (right)

You can print the document from a PDF file.

The procedure for obtaining an Aster 2020 or older notice is the same: select the corresponding tax year from 2012 to 2020

Aspir impots.gouv is also available for use

This process can be done with the impots.gouv smartphone app. The steps are as follows:

- Open the Impots.gouv mobile app

- S’identifier

- On the home page, click or touch the Documents button

- In the “Financial Documents” section, click or touch the “Notification of Circumstances Notifying the IR” button

This process is useful when you do not have a printer:

- Provide Austria in PDF format on the phone screen to the company requesting the evidence

- Send Astra by email or MMS by pressing the “Share” button

The only limitation: Documents that have been accessible in the application for the past three years (including the current year), only allow downloads:

- Astir 2021 in 2020 revenue

- Astir 2020 on 2019 income

- Astir 2019 in 2018 income

To restore the old asterisk, so you need to log in to the Impots.gouv.fr site in your personal space.

Astir 2021 Not Available: Why?

Aster is not available to all taxpayers: it is only available when an online notice is made and its status is current, which is similar to the fees that lead to income declaration and deduction or credit rights. Tax, entered in 2042 Notification Form (Major Income Tax Income).

Therefore, Astir is not available for the following situations and special events:

- Once we have completed a paper announcement

- When quietly declaring your income by automatically declaring income

- When a person receives unpaid professional income (self-employed, self-employed, farmer, etc.)

- When a person receives income from a foreign source (including a small amount of real estate income from SCPI)

- When you benefit from less common deductions or tax loans than donations to corporations

The Directorate General of Public Finance said Astir was not available to about 20% of taxpayers.

When to provide an arrow as evidence

Aster may be used as proof of address or income and expenses in the following situations (complete list):

- Evidence for establishing a family size of school canteen or extracurricular

- Proof of income for the landlord to sign the lease

- Proof of tax return to apply for community housing

- Proof of taxable income to apply for a high school scholarship

- Proof of taxable income to apply for a student grant

- Certificate of Tax Income (Ex-ACS / Ex-CMU-C) to make claim for complementary unity health

- Proof of income and fees for a bank or financial institution, savings account or when subscribing to a mortgage.

A coach, a work-study or a student affiliated with his or her parents’ financial family may present the latter’s astrology to prove their level of income.

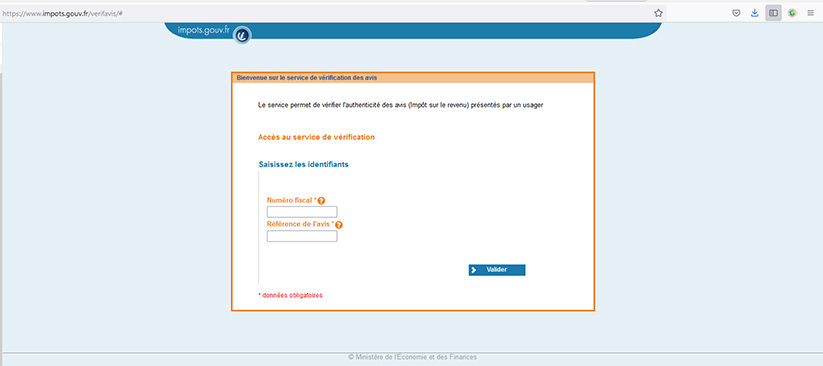

Third party online verification of Astrin

The owner of an organization (cafe, etc.), a town hall, a financial institution or a lessee can check the authenticity of an asterisk to make sure it is not counterfeit.

This process is carried out online at the following address: www.impots.gouv.fr/verifavis

You must enter:

- Astron’s tax number

- Notice of Document / Document: 13 digit number

Professional bacon fanatic. Explorer. Avid pop culture expert. Introvert. Amateur web evangelist.

More Stories

Acrylic Nails for the Modern Professional: Balancing Style and Practicality

The Majestic Journey of the African Spurred Tortoise: A Guide to Care and Habitat

Choosing Between a Russian and a Greek Tortoise: What You Need to Know